Preparations for Drilling at the Mkuju Uranium Project

HIGHLIGHTS

Dasa Uranium Project – Mineral Resource Estimate

- On May 23, 2023 , the Company announced the completion of an updated Mineral Resource Estimate (“MRE”) for the Dasa Project. The MRE includes the results of a 16,000-meter drill program that was designed to convert Inferred Resources to Indicated Resources and resulted in a 50% increase in Indicated Resources at a 1,500-ppm cut-off grade.

Dasa Uranium Project – Off-take Agreements

- In 2023, the Company formalized three off-take agreements with major North American utilities for the delivery of 1.4 million pounds U 3 O 8 per year for the first five years of mining. These off-take agreements represent a small percentage of the current 68.1 million pounds of production in the new 23.75-year Mine Plan and provide the Company with the ability to repay the debt financing facility, while maintaining leverage to a tightening uranium market.

Dasa Uranium Project – Mining

- Ramp development has been underway since the beginning of 2023, with over 950 meters completed. Mine development is now continuing down dip in the footwall of the orebody.

- In August 2023 , the closure of the Benin border interrupted the usual supply route from the Port of Cotonou through Benin to Niger . The Company suspended mine development due to interruptions of its supply chain and depletion of certain consumables until the Company established an alternate shipping route through Togo and Burkina Faso . Using this alternate route, underground mine development resumed in December 2023 .

- As of the date hereof, the Dasa Mine, operated by SOMIDA, and overseen by Global Atomic Corporation, achieved 595 days without a Lost Time Injury (“LTI”). This achievement is a testament to management’s dedication to create a safe work environment and the team’s success in implementing effective safety measures.

Dasa Uranium Project – Financing

- The Company is engaged with a Canadian export credit agency and a U.S. development bank to establish a debt facility to finance 60% of Dasa’s development costs. The Company has been advised by this banking syndicate that Credit Committee approval may occur in April 2024 , followed by final approval by the Board of Directors in June 2024 .

- Management continues to work towards the completion of this debt facility, however, the Company is also involved in discussions with other funding entities and will continue to evaluate alternative funding options that support a financing decision in the best interests of shareholders.

Dasa Uranium Project –Team

- In 2023, the Company added two key members to the Dasa management team: John Wheeler , Director of Operations and Site General Manager and Daniele Valentino , Deputy Director of Operations & Assistant General Manager. Both individuals have substantial West African mining experience and we welcome them to the SOMIDA operating team.

Niger Political Situation

- On February 14, 2023 , the Company announced that a local court in Agadez, Niger , had issued orders against the Government of Niger and the Company’s subsidiary in Niger , SOMIDA, in response to historical concerns raised by certain local organizations. On February 24, 2023 , the ruling was overturned and annulled as having no merit. SOMIDA continued mine development operations throughout the court proceedings.

- On July 26, 2023 , the Niger military initiated a change in government. The new Government of Niger subsequently confirmed its support of the Dasa Project and encouraged SOMIDA to proceed on schedule. The Economic Community of African States (“ECOWAS”) imposed wide-ranging sanctions on Niger , which were subsequently removed in early 2024. The Niger – Benin border is the only border that remains closed, however is expected to open soon.

- On October 10, 2023 , the United States formally recognized the events of July 26, 2023 , as a “Coup d’Etat”, which temporarily halted the U.S. Development Bank’s work on their debt financing facility for the Dasa development.

- In November 2023 , the U.S. Senate voted overwhelmingly to support continued U.S. military presence in Niger . The U.S. Under Secretary for African Affairs stated that the U.S. stands ready to support Niger in a successful transition to democratic rule and the U.S. Development Bank resumed its work on the debt facility for Dasa.

Turkish Zinc Joint Venture

- Operations were impacted by major earthquakes which occurred in Türkiye during Q1 2023. Local steel mills, which supply the Turkish Zinc Joint Venture (“BST” or the “Turkish JV”) with Electric Arc Furnace Dust (“EAFD”), ceased operations for a period of time before resuming operations.

- The Turkish JV processed over 66,000 tonnes EAFD to produce 27.2 million pounds of zinc in concentrate at an average realized price of US$1.20 /lb.

- The Company’s share of the Turkish JV EBITDA was a loss of $2.4 million in 2023 (a gain of $4.2 million in 2022).

- The revolving credit facility of the Turkish JV was US$12 million at the end of 2023 (Global Atomic share – US$5.9 million ).

- The cash balance of the Turkish JV was US$1.9 million at the end of 2023.

Corporate

- On March 17, 2023 , the Company completed a Bought Deal Prospectus Offering of 18,666,667 Units at a price of $3.00 per Unit for gross proceeds of approximately $56 million . Each Unit comprised one common share and one-half warrant exercisable at $4.00 per common share for a period of 18-months from closing.

- On November 21, 2023 , the Company filed a Short Form Prospectus for up to $350 million which amount includes up to $50 million that may be raised under an At-the-Market (“ATM”) equity program as per the supplemental prospectus filed December 6, 2023 , over the ensuing 25-month period.

- On December 22, 2023 , the Company completed a private placement of 9,000,000 Units at a price of $2.50 per Unit for gross proceeds of $15 million . Units comprised one common share and one-half common share purchase warrant. Each full warrant could be exercisable at $3.00 per share for a period of 12 months from closing subject to accelerated expiry should the price of the common shares exceed a volume weighted average price (“VWAP”) of $3.50 for 5 consecutive trading days. The acceleration clause was activated in January 2024 and all warrants exercised for gross proceeds of $9 million .

- Global Atomic continues to receive quarterly management fees and monthly sales commissions from the Turkish JV ( $690,000 in 2023 compared to $1,149,000 in 2022), helping to offset corporate overhead costs.

- Cash balance as of December 31, 2023 , was $24.9 million .

Subsequent Events

- In January 2024 , the Niger Government suspended the approval of new and/or renewed mineral exploration permits, including renewals recently received by the Company. This suspension was initiated to conduct an audit of recently issued exploration permits and related to undisclosed gold shipments. This announcement had no impact on the mining permits or operations at the Dasa Project and the Company expects its exploration permits to be renewed shortly.

- On March 5, 2024 , the Company released the results of its Dasa Uranium Project 2024 Feasibility Study (“FS”) as an update to its 2021 Phase 1 Feasibility Study which confirmed an extension of the Mine Plan from 12 years to 23.75 years (2026-2049), a 50% increase in Mineral Reserves to 73 million pounds U 3 O 8 and an increase in total production by 55% to 68.1 million pounds U 3 O 8 . Using an average uranium price of $75 /lb U 3 O 8 , the FS shows an NPV 8 of US$917 million , an IRR of 57% and a payback period of 2.2 years.

- On March 5, 2024 , the Company announced that it had signed a Letter of Intent from a European nuclear power utility to purchase U 3 O 8 from Dasa, representing its fourth off-take agreement for deliveries starting in 2026.

- On March 16, 2024 , Niger announced its intention to terminate its military cooperation agreement with the United Sates. Global Atomic understands the two countries are in discussions to reach a mutually acceptable resolution.

- On March 27, 2024 , the Company published the full Dasa Uranium Project Feasibility Study (“FS”), details of which are discussed in the “Uranium Business” section below. The FS is available at the Global Atomic web site and at www.sedarplus.ca .

Global Atomic President and CEO, Stephen G. Roman commented, ” I congratulate the entire team at Global Atomic, including those at our Niger

“We proved the impressive scope of Dasa early in 2023, when we published a revised Mineral Resource Estimate which converted Inferred Resources into 50% more Indicated Resources. We also delineated another 51.4 million pounds in the Inferred category that could eventually be brought into our next technical update. In early 2024, we announced a new Feasibility Study that extended the Dasa Mine Plan from 12 to 23 years, increased Mineral Reserves by 50% to 73 million pounds and uranium production by 55% to 68.1 million pounds. Using a conservative uranium base price of $75 per pound and very conservative cost assumptions that include several layers of contingencies, the Study forecasts a very attractive after-tax NPV and an impressive after-tax IRR.”

“The current roster of 275 employees at the Dasa Project, are continuing with underground and surface development to prepare for the processing plant erection planned to start later this year. The construction crews will begin arriving as the expanded camp is completed mid-year. I look forward to bringing further updates to shareholders as we continue to advance the Dasa Project to first Yellowcake production in Q1, 2026.”

OUTLOOK

Dasa Uranium Project

- Continue development of the underground ramp and site infrastructure to remain on schedule to supply uranium ore to the processing plant from the end of 2025.

- Addition of an in-country construction team, bringing the site complement from 275 to approximately 500.

- In Q2 2024, our Bank Syndicate is expected to approve the Debt Financing facility for the development of the Dasa Project.

- Complete final engineering, site development and civil works for the Dasa processing plant and begin installation of equipment.

- Continue marketing efforts to secure additional uranium off-take agreements.

Turkish Zinc Joint Venture

- The Company anticipates operations at its Turkish JV will be profitable in 2024 as local steel mills normalise production.

COMPARATIVE RESULTS

The following table summarizes comparative results of operations of the Company:

|

Year ended December 31, |

||||||

|

(all amounts in C$) |

2023 |

2022 |

||||

|

Revenues |

$ |

689,996 |

$ |

1,149,494 |

||

|

General and administration |

10,275,282 |

10,265,688 |

||||

|

Share of equity loss |

4,128,171 |

287,779 |

||||

|

Other expense |

– |

583,246 |

||||

|

Finance income, net |

(1,159,471) |

(155,142) |

||||

|

Foreign exchange loss |

4,032,344 |

2,666,330 |

||||

|

Net loss |

$ |

(16,586,330) |

(12,498,407) |

|||

|

Net income (loss) attributable to: |

||||||

|

Shareholders of the Company |

(16,603,680) |

(12,475,109) |

||||

|

Non-controlling interests |

17,350 |

(23,298) |

||||

|

Other comprehensive income |

$ |

913,394 |

$ |

901,107 |

||

|

Comprehensive loss |

$ |

(15,672,936) |

$ |

(11,597,300) |

||

|

Comprehensive gain (loss) attributable to: |

||||||

|

Shareholders of the Company |

(15,670,449) |

(11,630,229) |

||||

|

Non-controlling interests |

(2,487) |

32,929 |

||||

|

Basic and diluted net loss per share |

($0.08) |

($0.07) |

||||

|

Basic weighted-average |

198,082,525 |

177,647,065 |

||||

|

Diluted weighted-average |

198,082,525 |

177,647,065 |

||||

|

December 31, |

December 31, |

|||||

|

2023 |

2022 |

|||||

|

Cash |

$ |

24,857,915 |

$ |

8,400,008 |

||

|

Property, plant and equipment |

129,986,343 |

82,234,716 |

||||

|

Exploration & evaluation assets |

1,370,358 |

1,115,983 |

||||

|

Investment in joint venture |

12,628,251 |

16,387,040 |

||||

|

Other assets |

8,755,878 |

2,118,258 |

||||

|

Total assets |

$ |

177,598,745 |

$ |

110,256,005 |

||

|

Total liabilities |

$ |

19,412,976 |

$ |

8,746,681 |

||

|

Total equity |

$ |

158,185,769 |

$ |

101,509,324 |

||

The consolidated financial statements reflect the equity method of accounting for Global Atomic’s interest in the Turkish JV. The Company’s share of net earnings and net assets are disclosed in the notes to the financial statements.

Revenues include management fees and sales commissions received from the joint venture. These are based on joint venture revenues generated and zinc concentrate tonnes sold. Revenues in 2023 have decreased due to lower zinc prices and sales in the Turkish Zinc JV.

General and administration costs at the corporate level include general office and management expenses, stock option awards, costs related to maintaining a public listing, professional fees, audit, legal, accounting, tax and consultants’ costs, insurance, travel, and other miscellaneous office expenses.

Share of net earnings from joint venture represents Global Atomic’s equity share of net earnings from the Turkish Zinc JV.

Finance income includes interest earned from the short-term bank deposits. Finance income increased significantly in 2023, representing higher interest rates and higher cash balances on hand since the Company’s March 2023 equity raise.

Foreign exchange loss represents realized and unrealized exchange losses that arise from the translation of foreign currency denominated assets and liabilities to local currency. For the year ended December 31, 2023 , devaluation of the United States dollar relative to the West African Franc (“CFA”) and Canadian dollar resulted in $4 million foreign exchange loss.

Uranium Business

Niger Mining Company

Under Niger’s Mining Code, a Niger mining company must be incorporated to carry out mining activities. Société Minière de Dasa S.A. (“SOMIDA”) was incorporated on August 11, 2022 . The Republic of Niger received its 10% free carried interest in the shares of SOMIDA and elected to subscribe for an additional 10%, resulting in a total ownership of 20% of the shares. Under the terms of the Company’s Mining Agreement, the Republic of Niger commits to fund its proportionate share of capital costs and operating deficits for the additional 10% interest. The Republic of Niger has no further option to increase its ownership.

Mineral Resources

Since 2011, GAFC’s exploration activities have been primarily focused on the Dasa deposit. In 2018, GAFC began a drill program at an area identified as the “Flank Zone” to assess the potential for near-surface high-grade mineralization, as well as testing strike extensions of the deeper mineralization at depth. The Company was successful with both programs. The drilling identified significant amounts of high-grade mineralization in the Flank Zone and in several new zones along strike and down dip. This information guided the location of the 16,000-meter infill drilling program in 2021 and 2022 when the Company drilled a further 28 diamond drill holes for a total of 16,368 meters, targeting areas of Inferred Resources, so they could be upgraded to the Indicated category. Using this new data, AMC Consultants, (“AMC”), was engaged to prepare an updated Mineral Resource Estimate (“2023 MRE”) which they reported on with an effective date of May 12, 2023 .

Highlights from the 2023 MRE included a grade-tonnage report at varying cut-off grades and are summarized in the following table:

|

Grade-Tonnage report, highlights from 2023 MRE |

||||

|

Cut-Off |

Category |

Tonnes |

eU 3 O 8 |

Contained |

|

eU 3 O 8 , |

Mt |

ppm |

Mlb |

|

|

100 |

Indicated |

103.6 |

803 |

183.5 |

|

Inferred |

71.0 |

636 |

99.5 |

|

|

320 |

Indicated |

44.9 |

1,602 |

158.5 |

|

Inferred |

25.4 |

1,435 |

80.4 |

|

|

1,200 |

Indicated |

12.6 |

4,201 |

117.1 |

|

Inferred |

5.9 |

4,320 |

56.1 |

|

|

1,500 |

Indicated |

10.1 |

4,926 |

109.6 |

|

Inferred |

4.4 |

5,349 |

51.5 |

|

|

2,500 |

Indicated |

5.7 |

7,258 |

91.0 |

|

Inferred |

2.4 |

8,211 |

43.2 |

|

|

10,000 |

Indicated |

0.9 |

22,185 |

43.5 |

|

Inferred |

0.6 |

18,362 |

25.3 |

|

The 2023 MRE concluded on the following Mineral Resource Statement:

|

Category |

Tonnes |

eU 3 O 8 |

Contained Uranium Metal |

|

Mt |

ppm |

Mlb |

|

|

Indicated |

10.1 |

4,913 |

109.3 |

|

Inferred |

4.5 |

5,243 |

51.4 |

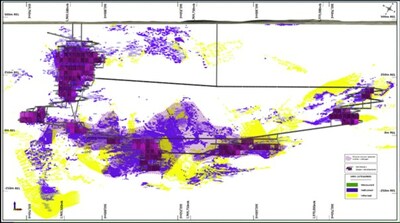

The following resource schematic shows the Indicated and Inferred resources as estimated in the MRE. Indicated Resources are shown in purple and Inferred Resources are shown in yellow

Reserves

Following the updated MRE, the Company has updated the previous Phase 1 Feasibility Study. The updated Feasibility Study (“2024 Feasibility Study”) was reported with an effective date of February 28, 2024 , and the full Feasibility Study was filed on SEDAR+ on March 27, 2024 .

The 2024 Feasibility Study estimated the following Mineral Reserves.

|

Mineral Reserve Category |

RoM (Mt) |

eU308 (ppm) |

U308 (t) |

U308 (Million lbs) |

|

Proven Mineral Reserve |

– |

– |

– |

– |

|

Probable Mineral Reserve |

8.05 |

4,113 |

33,097 |

73.0 |

Reserve Expansion

Enhancement of throughput and possible mill expansions will be investigated to improve and maintain the processing plant output. Achieving increased throughput will significantly lower the unit operating costs over time. Additional infill drilling is expected to upgrade Inferred Resources to the Indicated Resource category so these can be included in subsequent mine plans.

2024 Feasibility Study Results

2024 Feasibility Study on the Dasa deposit was completed using a uranium price of US$75 /pound U 3 O 8 . Key economic and production statistics are as follows:

|

Summary Project Metrics @ US$75/lb U 3 O 8 |

||

|

Project Economics (USD) |

||

|

After-tax NPV (8% discount rate) |

US$M |

$917 |

|

After-tax IRR |

% |

57 % |

|

Cash flow (before capex & taxes) |

US$M |

$2,948 |

|

Undiscounted after-tax cash flow (net of capex) |

US$M |

$1,839 |

|

After-tax payback period from Jan 2024 |

Years |

4.2 |

|

After-tax payback period from start-up |

Years |

2.2 |

|

Unit Operating Costs |

||

|

LOM average cash cost (1) |

$/lb U 3 O 8 |

$30.73 |

|

AISC (2) |

$/lb U 3 O 8 |

$35.70 |

|

Production Profile |

||

|

Mine Life |

Years |

23.75 |

|

Total tonnes of mineralized material processed |

M Tonnes |

8.05 |

|

Mill processing rate |

Tonnes/day |

1,000 |

|

Mill Head Grade |

ppm |

4,113 |

|

Overall Mill Recovery (2) |

% |

93.4 % |

|

Total Lbs U 3 O 8 processed |

Mlbs |

73.0 |

|

Total Lbs U 3 O 8 recovered |

Mlbs |

68.1 |

|

Average annual Lbs U 3 O 8 production (3) |

Mlbs |

2.9 |

|

Peak annual Lbs U 3 O 8 production |

Mlbs |

4.9 |

|

(1) |

Cash costs include all mining, processing, site G&A, and royalty costs, as well as Niamey head office and other off-site costs. All-in sustaining costs (“AISC”) include cash costs plus capital expenditures forecast after the start of commercial production. |

|

(2) |

Ramp up of the mill is assumed to take 11 months, during which recoveries increase. Once stable production levels have been achieved at the end of 11 months, the recovery rate stabilizes at 94.15%. |

The economic analysis for the Study was done via a discounted cash flow (“DCF”) model based on the mining inventory from the 2024 Feasibility Study Mine Plan at a price of US$75 per pound of U 3 O 8 . Sensitivity analysis was carried out at price intervals from US$60 per pound to US$105 per pound, as shown in the table below. The DCF includes an assessment of the current tax regime and royalty requirements in Niger . Net present value (“NPV”) figures are calculated using a range of discount rates as shown. The discount rate used for the base-case analysis is 8% (“NPV 8 “). NPV has been calculated by discounting net cash flows to the start of operations, January 1, 2026 , and deducting undiscounted remaining initial capital costs therefrom.

|

Economic sensitivity with varying uranium prices (USD) |

||||

|

Uranium price (per pound) |

$60/lb |

$75/lb |

$90/lb |

$105/lb |

|

Before-tax NPV @ 8% |

$656 M |

$1,122 M |

$1,572 M |

$2,022 M |

|

After-tax NPV @ 8% |

$551 M |

$917 M |

$1,269 M |

$1,621 M |

|

After-tax IRR |

38.2 % |

57.0 % |

74.8 % |

92.9 % |

The 2024 Feasibility Study is based on a plant throughput of 1,000 tonnes per day (t/d) or 365,000 tonnes per annum (t/a). The plant equipment has been designed for 1,200 t/d throughput but the 2024 Feasibility Study assumes plant availability of 86% (1,200 t/d x 86% = 1,032 t/d). The Arlit processing plants achieve 92% availability, by comparison. If SOMIDA has a similar experience, throughput would increase to about 1,104 t/d (1,200 t/d x 92% = 1,104 t/d). The plant layout has been optimised to enable the addition of more processing lines in the future. Much of the equipment has been over-sized by 20%, so minimal capital costs would be required to achieve throughput of 1,325 t/d (1,200 t/d x 1.2 x .92 = 1,325 t/d). Fixed mining, processing and site costs are significant, so increases in throughput would have a significant impact on reducing unit costs.

|

Operating Cost (1) (USD) |

LOM |

$/lb U 3 O 8 |

$/tonne of |

|

Mining Cost |

620.2 |

9.10 |

77.08 |

|

Processing Cost |

681.5 |

10.00 |

84.69 |

|

G&A Cost |

443.7 |

6.51 |

55.15 |

|

Cash Cost |

1,745.4 |

25.62 |

216.92 |

|

Royalties |

348.1 |

5.11 |

43.26 |

|

Total Cash Cost |

2,093.4 |

30.73 |

260.18 |

|

Sustaining Capital |

338.6 |

4.97 |

42.11 |

|

AISC (2) |

2,432.0 |

35.70 |

302.29 |

|

(1) Due to rounding, some columns may not total exactly as shown |

|

|

(2) All-in sustaining cost per pound of U 3 O 8 represents mining, processing and site G&A costs, royalty, off site costs and sustaining expenditures including closure costs, divided by payable 68.1 million pounds of U 3 O 8 |

|

As shown below, the mining grades are higher in the initial years than later, however, further drilling to include high grade Inferred Resources is expected to smooth the grade profile. The current Mine Plan grade profile is shown below.

Accordingly, ore processed will also vary in grade and impact cash cost in the various periods as follows:

|

2026-32 |

2033-40 |

2041-49 |

2026-49 |

|

|

Years |

7 |

8 |

8.75 |

23.75 |

|

Ore processed (MT) |

2.5 |

2.9 |

2.7 |

8.0 |

|

Grade (ppm) |

5,538 |

4,274 |

2,668 |

4,113 |

|

U 3 O 8 produced (Lbs M) |

27.6 |

25.4 |

15.2 |

68.1 |

|

Average Annual (Lbs M) |

3.9 |

3.2 |

1.7 |

2.9 |

|

Mining cost per pound |

$5.77 |

$8.84 |

$15.61 |

$9.10 |

|

Processing cost per pound |

$7.66 |

$9.35 |

$15.37 |

$10.00 |

|

G&A cost per pound |

$5.26 |

$6.08 |

$9.52 |

$6.51 |

|

Total cash cost per pound before royalties |

$18.69 |

$24.28 |

$40.50 |

$25.62 |

Capital costs for the production period were estimated as follows in the Feasibility Study:

|

Capital Costs (1) (USD) |

Initial Capital (2) ($million) |

Sustaining |

Total ($million) |

|

Mining |

58.8 |

218.7 |

277.5 |

|

Processing |

83.2 |

38.9 |

122.1 |

|

Infrastructure |

68.2 |

5.2 |

73.4 |

|

Total Direct Capital Costs |

210.2 |

262.8 |

473 |

|

Indirect & Owner’s Cost |

60.9 |

30 |

90.9 |

|

Total Direct and Indirect Capital Costs |

271.1 |

292.8 |

563.9 |

|

Contingency (3) |

37.2 |

29.9 |

67.1 |

|

Reclamation |

0 |

15.9 |

15.9 |

|

Total Capital Costs |

308.3 |

338.6 |

646.9 |

|

(1) |

Due to rounding, some columns may not total exactly as shown. |

|

(2) |

Initial capital is net of $67.2 million already spent to December 31, 2023, and before financing and corporate overhead charges |

|

(3) |

The contingency provision included in the initial capital cost estimate includes $7.9 million for mining. The contingency provision for sustaining capital costs is $29.9 million relating entirely to mining. |

Offtake Agreements

In 2023, the Company executed three uranium offtake agreements for sales to North American utilities. These agreements total between 6.9 and 8.4 million pounds U 3 O 8 over 6 years beginning in 2026. The higher amount assumes the exercise of options available to the buyers. On March 5, 2024 , the Company announced that it had received an LOI for the sale of uranium to a strategic European nuclear power utility for up to 780,000 pounds U 3 O 8 over 3 years beginning in 2026. These offtake agreements provide the Company with the ability to repay project construction loans while maintaining leverage to a firming U 3 O 8 price.

Niger Political Situation

On July 26, 2023 , the military in Niger placed the President under house arrest and assumed day-to-day operation of the Government. This move was widely condemned by the international community. The Economic Community of West African States (‘ECOWAS’) imposed sanctions on Niger , resulting in the closure of Niger’s borders and air space. Many ECOWAS countries did not support the border closures imposed by ECOWAS and all borders remained open to economic and human traffic, except Nigeria and Benin . The Benin route from the Port of Cotonou has historically been the main supply route for Niger , so its border closure has disrupted the Company’s supply chain, which resulted in the Company discontinuing mine development activities in August. An alternative supply route through the Port of Lome, Togo and through Burkina Faso developed and with the replenishment of mining supplies, SOMIDA was able to resume mine development activities in December.

On February 24, 2024 , ECOWAS removed all sanctions. Although ECOWAS no longer restricts border crossings, the Niger – Benin border remains closed from the Niger side but is expected to open soon.

Project Development Schedule

Mine development activities at the Dasa Project have been underway since November 2022 . The current mine plan has been developed to coincide with the start-up of the processing plant at the beginning of 2026, with a target surface stockpile of 2 to 3 months production available for the processing plant at any time. Long lead equipment purchases have been made and detailed engineering is well advanced. Although some earthworks projects have been undertaken by SOMIDA and its staff over the past year, full-scale earthworks have been contracted and will get underway in April. Civils works will follow, and processing plant equipment will begin arriving at site in Q4 2024. Erection of the processing plant and site infrastructure will take place from Q4 2024 through Q4 2025, with hot commissioning completed by January 2026 . Processing of ore through the plant is expected to begin in January 2026 .

Project Financing

The Company has been advancing Project Financing. The Project Financing is being negotiated with a Canadian export credit agency and a U.S. development bank. On October 10, 2023 , the Company announced that because of the Coup d’Etat designation of the situation in Niger by the U.S. Government, the U.S. development bank would temporarily put the project financing on hold. The Company was subsequently advised that the U.S. Government expressed support for the Dasa Project and the U.S. development bank was authorized to re-engage with the Company. The banks are continuing their review and finalization of credit committee documentation, with target credit committee approval in April 2024 , final Board approval in June and documentation thereafter. It is expected that the project financing will provide 60% of the total project costs plus 50% of the cost overrun facility.

The Company is also in discussions with alternative financing sources that are available. Such parallel discussions will continue so that alternative financing is available in case the banks choose not to proceed.

Turkish Zinc JV EAFD Operations

The Company’s Turkish EAFD business operates through a joint venture with Befesa Zinc S.A.U. (“Befesa”), an industry leading Spanish company that operates a number of Waelz kilns throughout Europe , North America and Asia . On October 27, 2010 , Global Atomic and Befesa established joint venture, known as Befesa Silvermet Turkey, S.L. (“BST” or the “Turkish JV”) to operate an existing plant and develop the EAFD recycling business in Türkiye. BST is held 51% by Befesa and 49% by Global Atomic. A Shareholders Agreement governs the relationship between the parties. Under the terms of the Shareholders Agreement, management fees and sales commissions are distributed pro rata to Befesa and Global Atomic. Net income earned each year in Türkiye, less funds needed to fund operations, must be distributed to the partners annually, following the BST annual meeting, which is usually held in the second quarter of the following year.

BST owns and operates an EAFD processing plant in Iskenderun, Türkiye. The plant processes EAFD containing 25% to 30% zinc that is obtained from electric arc steel mills, and produces a zinc concentrate grading 65% to 68% zinc that is then sold to zinc smelters.

Global Atomic holds a 49% interest in the Turkish JV and, as such, the investment is accounted for using the equity basis of accounting. Under this basis of accounting, the Company’s share of the BST’s earnings is shown as a single line in its Consolidated Statements of Income (Loss).

The following table summarizes comparative operational metrics of the Iskenderun facility.

|

Year ended December 31, |

|||

|

2023 |

2022 |

||

|

100 % |

100 % |

||

|

Exchange rate (C$/TL, average) |

17.60 |

12.71 |

|

|

Exchange rate (US$/C$, average) |

1.35 |

1.30 |

|

|

Exchange rate (C$/TL, period-end) |

22.32 |

13.81 |

|

|

Exchange rate (US$/C$, period-end) |

1.32 |

1.35 |

|

|

Average monthly LME zinc price (US$/lb) |

1.20 |

1.58 |

|

|

EAFD processed (DMT) |

66,264 |

76,738 |

|

|

Production (DMT) |

18,999 |

23,486 |

|

|

Sales (DMT) |

19,145 |

24,116 |

|

|

Sales (zinc content ‘000 lbs) |

27,245 |

35,159 |

|

Global steel production held steady in both 2022 and 2023, maintaining a total output of 1,888 million tons. However, regional performances varied; Chinese production remained unchanged, India saw a notable increase of 11.8%, the European Union experienced a decline of 7.4%, North America and Türkiye saw decreases of 1.3% and 4%, respectively.

In October 2023 , the World Steel Association released its short-term forecast for demand, anticipating a 1.8% increase in global demand for the year and a subsequent growth of 1.9% in 2024. The decline in construction activities resulting from the devaluation of the Turkish Lira and soaring inflation rates contributed to a reduction in steel demand in 2022. However, Turkish steel demand is expected to record very high growth where the construction sector is expected to grow by 15% due to the rebuilding and reinforcing efforts in high earthquake-risk areas.

The impact of the Ukrainian conflict on global steel markets is uncertain, however as exports from Russia and Ukraine have historically accounted for 10% of global steel exports, it is likely a material percentage of this supply will be replaced by increased production in other countries.

The following table summarizes comparative results for 2023 and 2022 of the Turkish Zinc JV at 100%.

|

Year ended December 31, |

|||

|

2023 |

2022 |

||

|

100 % |

100 % |

||

|

Net sales revenues |

$ 30,169,363 |

$ 59,692,797 |

|

|

Cost of sales |

36,191,503 |

53,305,420 |

|

|

Foreign exchange gain |

1,044,080 |

2,125,012 |

|

|

EBITDA (1) |

$ (4,978,060) |

$ 8,512,389 |

|

|

Management fees & sales commissions |

1,340,722 |

2,351,031 |

|

|

Depreciation |

4,212,207 |

3,542,154 |

|

|

Interest expense |

1,871,300 |

1,367,379 |

|

|

Foreign exchange loss on debt and cash |

6,338,816 |

3,790,623 |

|

|

Monetary gain |

(1,479,549) |

(398,798) |

|

|

Tax expense (recovery) |

(8,836,717) |

(1,552,695) |

|

|

Net loss |

$ (8,424,839) |

$ (587,305) |

|

|

Global Atomic’s equity share |

$ (4,128,171) |

$ (287,779) |

|

|

Global Atomic’s share of EBITDA |

$ (2,439,249) |

$ 4,171,071 |

|

|

(1) |

EBITDA is a non-IFRS measure, does not have a standardized meaning prescribed by IFRS and may not be comparable to similar terms and measures presented by other issuers. EBITDA comprises earnings before income taxes, interest expense (income), foreign exchange loss (gain) on debt and bank, depreciation, management fees, sales commissions, losses (gains) on sale of property, plant, and equipment. |

All the financial statement line items included in the Turkish Zinc JV consolidated statements of loss include the impact of hyperinflation accounting for the years ended December 31, 2023 and 2022. Non-monetary assets and liabilities which are not carried at amounts current at the balance sheet date, and components of shareholders’ equity are restated by applying the relevant conversion factors. All items in the statement of income are restated by applying the relevant (monthly) conversion factors.

The Turkish Zinc JV experienced lower revenues in 2023 compared to 2022, due to processing less EAFD and lower zinc prices. Fortunately, the plant was under a scheduled maintenance shutdown in January 2023 . Due to the earthquake on February 6, 2023 , the plant eventually resumed operation following a thorough inspection in March 2023 . Revenues were also negatively impacted by the zinc price. The average monthly LME zinc price declined to US$1.20 /pound in 2023 from US$1.58 /pound in 2022.

The Turkish Zinc JV incurred increased expenses in 2023. The Ukrainian conflict, post-COVID demand increases, raw material shortages and global logistics challenges resulted in substantial inflationary pressures on all costs. Moreover, The Turkish Zinc JV also incurred extraordinary expenses related to the massive earthquakes, such as fixed costs incurred due to the unplanned stoppage. The Turkish Zinc JV also realized negative impact of EAFD purchase contracts that were entered into when zinc prices were much higher. Combined with the negative impact of hyperinflation accounting on operating costs, the overall result was a negative EBITDA during 2023.

The cash balance of the Turkish Zinc JV was US$1.2 million at December 31, 2023 .

The local Turkish revolving credit facility balance was US$12.0 million at December 31, 2023 ( December 31, 2022 – US$8.3 million ) and bears interest at 11%. The Turkish revolving credit facility can be rolled forward.

The loans are denominated in US dollars but converted to Turkish Lira for functional currency accounting purposes. For presentation purposes, the equity interests are then converted to Canadian dollars. The foreign exchange loss for the 12 months ended December 31, 2023 , related to the Turkish JV debt and cash balances was $6.3 million (loss of $3.8 million in 2022).

The foreign exchange loss is an unrealized loss, and largely relates to the devaluation of the Turkish Lira relative to the US dollar from 18.7 on December 31, 2022 , to 29.5 at December 31, 2023 . In economic terms, all revenues are received in US dollars and these will be used to pay down the US denominated debt, so no exchange gains/losses will be realized in USD terms. The accounting exchange losses relate to the debt and cash balances are shown below EBITDA as a financing related cost.

The increase in tax recovery in 2023 is mostly related to the timing differences of application of Financial Reporting in Hyperinflationary Economies, between the IFRS financial statements and the statutory tax financial statements. The Turkish Zinc JV’s IFRS financial statements applied IAS 29 in 2022, whereas Financial Reporting in Hyperinflationary Economies was applied in 2023 to the statutory financial statements.

Overall, the Company’s share of EBITDA was a loss of $2.4 million in 2023 ( $4.1 million at 100%). After deduction of management fees, sales commissions and interest expense, depreciation, foreign exchange losses, other income and taxes, the Company’s share of net loss was $4.1 million for 2023 ( $8.4 million at 100%).

QP Statement

The scientific and technical disclosures in this Management’s Discussion and Analysis have been extracted from the 2024 Feasibility Study, which was reviewed and approved by Dmitry Pertel , M.Sc., MAIG, John Edwards , B.Sc. Hons., FSAIMM, Andrew Pooley , B. Eng (Hons) ., FSAIMM who are “qualified persons” under National Instrument 43-101 – Standards of Disclosure for Mineral Properties.

About Global Atomic

Global Atomic Corporation ( www.globalatomiccorp.com ) is a publicly listed company that provides a unique combination of high-grade uranium mine development and cash-flowing zinc concentrate production.

The Company’s Uranium Division is currently developing the fully permitted, large, high grade Dasa Deposit, discovered in 2010 by Global Atomic geologists through grassroots field exploration. The “First Blast Ceremony” occurred on November 5, 2022 , and commissioning of the processing plant is scheduled for Q1, 2026. Global Atomic has also identified 3 additional uranium deposits in Niger that will be advanced with further assessment work.

Global Atomic’s Base Metals Division holds a 49% interest in the Befesa Silvermet Turkey, S.L. (BST) Joint Venture, which operates a modern zinc recycling plant, located in Iskenderun, Türkiye. The plant recovers zinc from Electric Arc Furnace Dust (EAFD) to produce a high-grade zinc oxide concentrate which is sold to zinc smelters around the world. The Company’s joint venture partner, Befesa Zinc S.A.U. (Befesa) holds a 51% interest in and is the operator of the BST Joint Venture. Befesa is a market leader in EAFD recycling, with approximately 50% of the European EAFD market and facilities located throughout Europe , Asia and the United States of America .

The information in this release may contain forward-looking information under applicable securities laws. Forward-looking information includes, but is not limited to, statements with respect to completion of any financings; Global Atomics’ development potential and timetable of its operations, development and exploration assets; Global Atomics’ ability to raise additional funds necessary; the future price of uranium; the estimation of mineral reserves and resources; conclusions of economic evaluation; the realization of mineral reserve estimates; the timing and amount of estimated future production, development and exploration; cost of future activities; capital and operating expenditures; success of exploration activities; mining or processing issues; currency exchange rates; government regulation of mining operations; and environmental and permitting risks. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “is expected”, “estimates”, variations of such words and phrases or statements that certain actions, events or results “could”, “would”, “might”, “will be taken”, “will begin”, “will include”, “are expected”, “occur” or “be achieved”. All information contained in this news release, other than statements of current or historical fact, is forward-looking information. Statements of forward-looking information are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Global Atomic to be materially different from those expressed or implied by such forward-looking statements, including but not limited to those risks described in the annual information form of Global Atomic and in its public documents filed on SEDAR from time to time.

Forward-looking statements are based on the opinions and estimates of management at the date such statements are made. Although management of Global Atomic has attempted to identify important factors that could cause actual results to be materially different from those forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance upon forward-looking statements. Global Atomic does not undertake to update any forward-looking statements, except in accordance with applicable securities law. Readers should also review the risks and uncertainties sections of Global Atomics’ annual and interim MD&As.

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy and accuracy of this news release.

SOURCE Global Atomic Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2024/27/c3684.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2024/27/c3684.html

Comments are closed.